Silicon Valley has been home to the brightest minds in the US and countries around the world for the last 20-25 years. Young geniuses who said their goal was not to make money but to find solutions to mankind’s problems and meet their vital needs required little capital. This idealistic influx created its own billionaires. The tech giants influencing investors also managed to captivate the public with promises of a brighter future.

But will the end of empires be built by tech geniuses? The soaring interest rates in the US, which have been at one of their lowest levels in history, is making hot money difficult for many tech companies, from the largest to the smallest. The future of the company is at stake. Experts say the tech bubble of the late ’90s and early 2000s, dubbed the “dot-com bubble,” is about to burst. Furthermore, the destruction this time is expected to be just as big as the companies are much larger.

class=”medianet-inline-adv”>

Jim Chanos, the founder of Kynikos Associates, is considered one of the “people who see the coming crisis” in the Wall Street realm. Chanos’ company is known for short selling in the days when the first tech bubble was about to burst.

Chanos recently told Insider that the corporate collapse this time could be bigger and that it could affect the U.S. and global economy more than 20 years ago, saying:

“A typical short sale in the early 2000s was $2-3 billion companies. This time we’re talking about $20-30 billion companies. That’s why we call the era the ‘doping dot-com era’. I think about that a lot after companies will disappear. Many will be reset.”

10 YEARS AGO 10 YEARS AFTER

For the past few decades, prominent figures from Silicon Valley have said that money is the fuel of innovation. Today, however, market conditions in which companies have begun to destabilize show us that money is not only fuel, but also the captain, the engine and the ultimate goal. Under these circumstances, many notable tech companies are forecast to come to an end in the next few years.

class=”medianet-inline-adv”>

Just 10 years ago, the technology world was in its heyday. Facebook went public and reached 1 billion users. Both he and Twitter had become the main weapon of the democracy fighters during the Arab Spring. Mark Zuckerberg’s promise to “connect the world” didn’t seem threatening at all. Elon Musk started an electric car revolution with the support of the US government. Apps like Uber and Lyft competed with each other to offer cheaper and more convenient travel. Cryptocurrencies were like fun toys that only interested enthusiasts. Celebrities have even tweeted about what they had for lunch.

Behind all this excitement was an economy designed to support Silicon Valley’s fast-growing companies. The 2008 crisis was over, there was plenty of money on the market, interest rates were low enough for easy borrowing. Money flowed into the stock market. Silicon Valley’s promises attracted both for-profit investors and a society struggling to emerge from economic disaster.

class=”medianet-inline-adv”>

A lot has changed in 10 years. The world has decided that the bonds created by social media are not such a good thing. Many negative aspects of the platforms surfaced, from interfering in elections to poisoning relationships. The Uber-Lyft rivalry hasn’t even worked for the companies themselves. The cryptocurrency world has grown into a cult. Elon Musk has moved to Twitter.

First, the luster of Silicon Valley’s promise of social benefits faded, and then the financial benefits it would offer, to a point, turned out to be. Tech companies began to suffer at every stage as the fast-growing startups and interest rates that made tech companies attractive disappeared. Startup supporters began telling founders to prepare for the worst. Even the biggest venture capital firms, including giants like SoftBank, began slashing their investments by 50 percent or more. As stocks fell in value, even the largest companies’ salaries became unsustainable.

class=”medianet-inline-adv”>

Jim Chanos

“THERE IS A GREAT PARALLEL”

As social welfare discourses gradually disappear, investors are beginning to believe that the driving force behind Silicon Valley’s business model is not technological intelligence, but over-the-top rhetoric. In a statement to Insider, Chanos pointed out that the same thing happened during the previous bubble burst.

Back then, according to Chanos, anything with “dot-com” in the name or business plan was considered marketable. Today’s magic words are “blockchain”, “machine learning”, “artificial intelligence” and “algorithm”. “There’s a big parallel here,” said Chanos.

class=”medianet-inline-adv”>

Speaking to Insider on condition of anonymity, one startup founder explained that talking about financial metrics is considered a huge mistake in Silicon Valley culture. The source in question stated that questions about profitability were always given standard answers, such as: B. “Amazon hasn’t made a profit for years, see how it is now.”

This strategy worked well when there was a lot of money in the financial markets, stocks appreciated and customer numbers increased. Today, the CEOs of companies unable to benefit from the removal of these conditions have begun to take refuge in the “sustainability” discourse.

Uber CEO Dara Khosrowshahi told employees they were cutting costs. Snapchat’s announcement that we’re slowing hiring, which has made gains in just one quarter for 10 years, sent all tech stocks plummeting. Coinbase, the largest cryptocurrency exchange in the US, has had to make a rather dubious statement to its investors that “we have no risk of bankruptcy, but if we go bankrupt our customers could lose all their assets”. Even the 20-year-old Tesla, which finally started turning a profit in 2020, began losing its Wall Street investors due to troubles in China, rising competition, and Musk’s pursuit of Twitter.

According to Jim Chanos, founder of Kynikos Associates, technology stocks have fallen sharply this year, but their stock values are not yet able to reflect the truth about the companies’ financial health. In other words, Chanos expects much bigger losses in the coming period.

THE VALUE OF THE SHARES DISTRIBUTED TO EMPLOYEES AT ANY TIME…

Technology giants not only fascinated their investors with their rhetoric about the future, but also their employees. Companies that paid employees in stocks instead of cash were driven by promises of future profitability. In addition, companies have been able to free up their balance sheets and turn losses into profits by reducing their personnel costs.

Chanos explained the situation by saying, “You make a generous payment to everyone, and it doesn’t become an expense until your shares go down in value. When that happens, you either have to split the shares or pay people cash.” However, these companies do not keep cash in their vaults. By splitting the shares, the value drops even further.

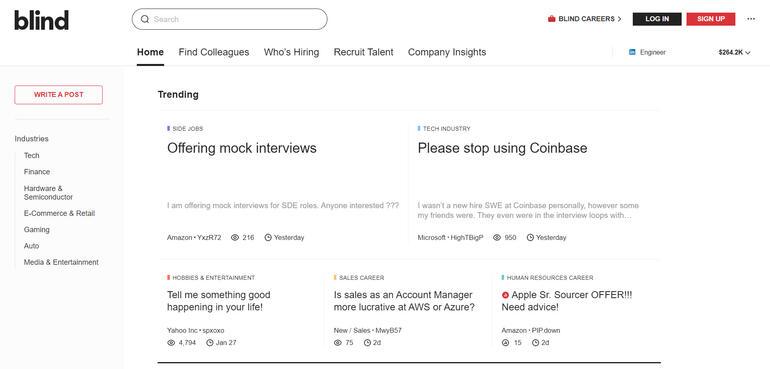

Many companies like Tesla, Twitter, Square continued the policy of paying with shares for a very long time. Therefore, the decline in the value of shares also affects employees today. It is enough to look blind to understand the magnitude of this blow.

Part job posting site and part social media platform, Blind is a gathering place for the 5 million people who work at Silicon Valley companies. According to site rules, users’ names are kept confidential, but they are required to disclose the companies they work for. Disclosure of individuals’ annual income is not required by the site rules, but is an accepted practice among users. In fact, users who keep it secret are told in plain language: “If you don’t disclose your salary, walk away”. Job postings also flash in a corner of the page: (annual salary)

Google software developer: $217,000.

Apple hardware engineer. 194 thousand dollars.

Apple software developer: $411,000.

Yahoo Designer: $398,000.

Until recently, these four examples might have been enough to explain Silicon Valley’s appeal. But these days, when tech companies stopped buying and started laying off employees after the stock fell in late May, blind users post that they’re starting to search their old age by candles.

6 LEVEL GOODS “HAZELNUT PEANUT MONEY”

Of particular note are the contributions in the “Mental Health” section of Blind. For example, one employee wrote: “Crazy things happen at my place of work.

The number of those who share “I was fired” has increased noticeably. Because of the sudden loss they incur as the stock falls in value, people ask, “Would I buy the house I live in if I had the opportunity?” has doubts.

In early May, blind users said, “Is the secret to happiness in working hard and earning big, or in balancing work and personal life?” Be able to make 6-figure salaries no matter how hard we work?” there are doubts. Many users put the peanut emoji that means “peanut peanut money” in the space where they need to write their total income.

Insider’s “‘Lots of companies getting vaporized’: Silicon Valley’s tech titans are in serious trouble — and they’re going to take the rest of the stock market down with them” and “‘Crazy things happen to me’ at work: Silicon Valley engineers just freaking out”.

#Twilight #Silicon #Valley #Scary #prediction #divine #predicted #collapse #years

No comments:

Post a Comment