KUTAY KORAP-BLOOMBERG HT RESEARCH

The largest share purchase in Turkish banking history has been completed.

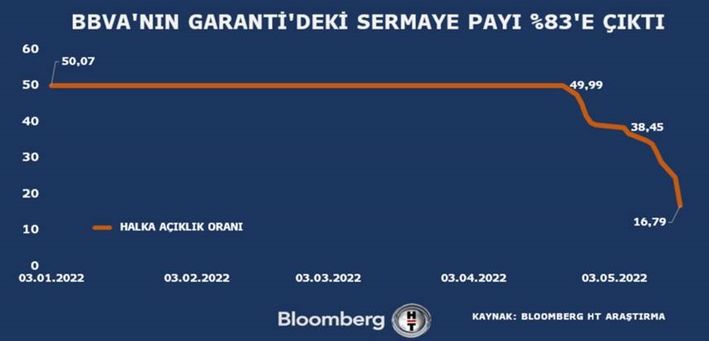

While BBVA’s voluntary takeover bid for Garanti BBVA ended today, the Spanish bank was seen to have significantly increased its stake in Garanti over the period.

As of May 17, 2022, BBVA’s equity interest in Garanti BBVA increased to 83.13 percent. Before the purchase, this rate was 50 percent.

With the buyback, the bank’s free float fell to less than 17 percent.

Shares of the bank have traded around 15.00 TL in the last 15 trading days.

Market analysts pointed out that there is a risk of exit from international indices due to the significantly reduced free float. On the other hand, some institutes assume that the volatility of the share could increase after the end of the voluntary share purchase. Recently, Garanti BBVA has been removed from the model portfolios of non-bank banks and intermediaries.

The process began in November 2021

In November 2021, Spanish bank BBVA decided to make a voluntary takeover bid to acquire shares in Garanti BBVA that it does not own.

For the remaining Garanti BBVA shares, the bank initially determined the bid-ask price of 12.20 TL per share. At that point, BBVA held a total of 2.09 billion shares in Garanti Bank, representing 49.85 percent of their total capital.

In April 2022, BBVA increased its share purchase offer for Garanti BBVA from TL 12.20 per share to TL 15.00 and set the final day of the proceedings for May 18, 2022.

In addition, the bank announced that the difference of 2.80 TL per share between the two offers will be paid until May 6, 2022 to investors who have already sold their shares to BBVA as part of the voluntary takeover bid.

What do institutions think about Garanti BBVA?

- Yapı Kredi Investment: We continue to like the bank in terms of medium and long-term attractive multiples, but we think that Turkey’s CDS ratio, which has recently increased, reflects the high negative history of real interest rates and the possible switch to inflationary accounting due to high Inflation may pose a risk to the Bank’s profitability in the short term. We are removing Garanti from our model portfolio in line with our preference to reduce our bank weighting. We maintain our Buy recommendation on the bank with a price target of TL 20.1.

- Gedik Investment: Considering that Akbank and Yapı Kredi, two private banks similar to Garanti, recently fell 20% while Garanti shares remained stable, we remove Garanti Bank from our model portfolio as the risk of a Volatility after purchase exists Garanti shares.

- In addition, Deniz Yatırım and Ünlü&Co announced that they have removed Garanti BBVA from their model portfolio.

Speaking on the matter, Vakıf Investment Director Altan Aydın assessed the process as follows: BBVA’s voluntary call for Garanti Bank acted as a catalyst for the bank and the stock market for a while. After the tender, Garanti BBVA will be the stock with the lowest free float of 17% in the BIST 30 index.

In this respect, there is an opportunity to move more strongly in both directions, and volatility will increase. Of course, this actual circulation level also carries an exit risk from some international indices, which also creates the possibility of an outflow of around $90 million. Although volatility at Garanti Bank will increase, we believe the bank is still cheap in terms of balance sheet performance and profitability.

Brokers tend to exclude them from model portfolios in view of short-term volatility. Regarding the market, with this call, which was more important for the performance of other companies, approximately 21 billion TL wasted since April 4th started circulating in the market. In the next period – which we have already seen in the last 1-2 weeks – the lack of a catalyst makes for fluctuations, I think that industrial companies with their own momentum are one step ahead. As a result, BBVA increased its stake as requested, and we can even say that it achieved its goal with a relatively affordable price.

#historical #purchase

No comments:

Post a Comment