The Central Bank of the Republic of Turkey (CBRT) lowered its inflation forecast for the end of 2022 to the same level as the medium-term programme.

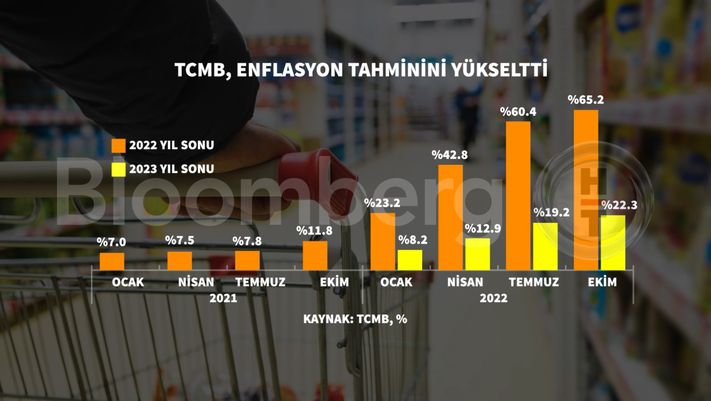

In the last inflation report of the year, the bank’s year-end inflation forecast was raised from 60.4 percent to 65.2 percent. The CBRT, which predicted that inflation would end at 65.2 percent in 2022, predicted a sharp drop in the following year. Accordingly, the CBRT forecast inflation of 22.3 percent in 2023. In the previous report, this estimate was given as 19.2 percent.

The CBRT also increased its forecasts for indicators that provide data for these expectations. The food inflation expectation for the end of 2022 has been increased from 71.3 percent to 75 percent. The median crude oil price forecast for 2022 rose from $99.6 to $100.5.

At the presentation, CBRT Chairman Şahap Kavcıoğlu defended the interest rate path, saying, “We expect that the decisions we make will significantly contribute to the continuity of supplies, investments and exports by increasing the resilience of our economy in 2023.” “

In his presentation, Kavcıoğlu said: “We are living through a period of growing pessimism about global growth and geopolitical risks constantly increasing. In such an environment, it is necessary to support the financial conditions, especially through the cost of financing. to maintain the momentum achieved in industrial production, which is the most important element of our structurally strengthened current overcapacity, and the increase in employment, we think,” he said.

Questions about currency-hedged deposits remain unanswered

The question-and-answer portion of the presentation left unanswered the previously disclosed questions about the cost of exchange-backed deposits at the CBRT.

Chairman Kavcıoğlu responded to the above questions that the bank did not disclose any income-expense items during the year and they would disclose all items on their balance sheets at the end of the year. Kavcıoğlu said there are commissions they pay to strengthen not only the KKM but also other reserve resources and they should be assessed together.

Kavcıoğlu emphasized that in this regard it is not about hiding or concealing anything, stressing that all accounts can be seen on the bank’s balance sheet after two months.

“The possibility of systemic risk in banks is nil”

One of the main topics that came up in the Q&A session was balance sheet risk, which the banking sector drew attention to as a result of the CBRT’s Securities Establishment Regulations.

In this regard, Minister of Finance and Finance Nureddin Nebati held a meeting with the general directors of the bank and it was stated at the meeting that the banks had complained about this issue.

Kavcıoğlu stated that they are closely monitoring the risks of the banking sector together with the Banking Regulatory and Supervisory Board, saying, “Why should we take steps that create systemic risks?”

Asked at the inflation report meeting that the banks had raised concerns about systemic risk in their meeting with Minister of Finance and Finance Nureddin Nebati, Kavcıoğlu said: “We have not received any such information from the friends attending this Meetings attended by the banks. Nothing has been passed on to us and I don’t think it’s right to talk about it,” he said.

Kavcıoğlu said he was aware of the meeting and explained that there had been no CBRT presidents at similar finance ministers’ meetings in the past.

Kavcıoğlu stated that all the metrics of the banking sector are very strong, saying, “There may be concerns, but the possibility of systemic risk is nil.”

Kavcıoğlu said: “Anyone can buy Turkey’s 10-year and 5-year bonds. The Treasury should also start issuing 20-year bonds,” he said.

#CBRT #raises #yearend #inflation #forecast #percent

No comments:

Post a Comment