Iris Cibre*

The whole community is talking about the banking movement these days.

I’ve been in this market for 24 years, I’ve worked with the great specialists of that time in this market, I still speak to many of them. None of us have seen such a move, even though our rating has been upgraded to investment grade.

So what happened now?

First I say what is a stock market, let’s start with that;

It is an organized market where companies come together to provide financing and investors to invest in a company as partners and generate returns.

The organized market, on the other hand, is a set of systems that ensure that all these transactions are conducted within the rules, supervised and making decisions to protect the investor. Borsa İstanbul brings traders together, CMB monitors these transactions to ensure they are processed within the law, Takasbank carries out the clearing of transactions.

CMB has one of the most important tasks at this point. supervision and regulation. She develops some rules to keep big capital from swallowing up small capital in the markets, makes sure they are applied and shows the penalty or caution card when not applied. These penalties have many levels.

I would like to give you an example of the gross clearing action in our current situation.

Gross clearing is used when stocks are increasing abnormally and rapidly. This is primarily intended to protect small investors, because rapid increases tend to fall sharply. When a stock goes through an unusual 3- to 5-day cap (each cap represents a 10 percent up move) without notice, CMB typically opts for a gross swap. Many investors in the stock market have experienced this, it’s a bit annoying; With a gross traded stock, it is not possible to trade stepwise on credit, online trading is prohibited, transactions can be made by calling the dealer, and most importantly, intraday trading and short selling cannot be done, you can only sell that what you sell Bought today, but the next day. As I said, the point here is to protect the investor and prevent a rapid decline in the rapidly rising stock.

Now let’s move on to the banking sector;

The sector is up 110 percent in the stock market in 2 months and some stocks are up 250 percent.

So what happened that these banks rose so quickly?

Our credit ratings rose, foreigners’ contractual frameworks allowed investment, and they flocked to the BIST in droves.

no

(ps. There was an inflow of 750 million dollars, but this can not ensure that all banks act at this rate above 100 percent, no real foreign investor buys goods in this way, sneaks up, does not show off)

What economic policy decisions have been made to increase bank profits?

No, also vice versa!

Banks were undervalued?

Yes, they were very low on a dollar basis, they even made a loss on a TL basis, but there was a reason for that. They could not act because there was no accounting for inflation, their real profits could not be calculated, the amount of credit issued was unknown, foreign investors did not enter the market with the power to support banks, and their maturing equity was rapidly eroding to the rise in exchange rates.

But suddenly a magic wand came, the banks acted simultaneously, all foreign and domestic investors, speculators and operators were immersed in these stocks – right?

Or was a group of people who, by absorbing almost all the goods in the market, took the pockets of those opening a short position (selling a short position, i.e. selling a stock contract you don’t have) as an uptrend move continued and pushed shares higher?

Of course, it is not possible for a single person to push our stock market’s flagship banks up by this scale, if there is such a person or group, who would support them?

There are many myths about the answers to these on the market. Our task is not to write after the myths, let’s return to the visible facts.

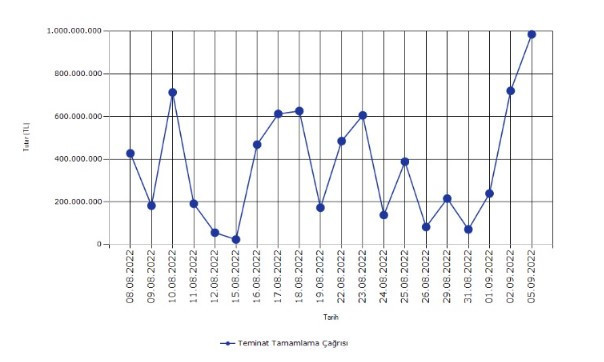

First fact; Many stockbrokers who had never experienced such a rise went bankrupt. Margin calls are not coming down from the highs.

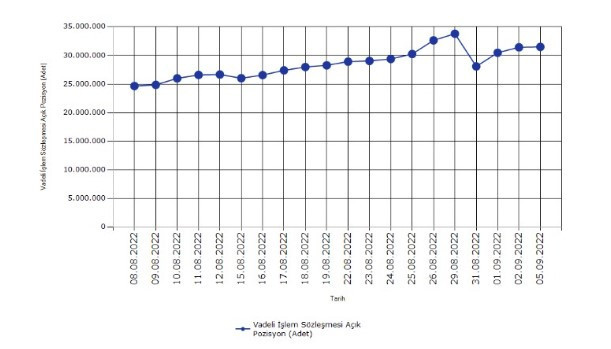

The number of open contracts in the futures markets is at its peak, up 33 percent in just one month.

The number of open contracts in the futures markets is at its peak, up 33 percent in just one month.

When we think that most of these bank stocks could be in the hands of a certain group, it’s a matter of curiosity as to who and how they’ll sell these stocks at these prices.

When we think that most of these bank stocks could be in the hands of a certain group, it’s a matter of curiosity as to who and how they’ll sell these stocks at these prices.

When we try to sell to the crowd of buyers that will come at these prices in the cash market, the possibility of a rapid depreciation of the shares comes to mind. So, aren’t sellers making a loss when their costs go up with the stocks they’re pushing higher every day?

Most likely they have made such a leveraged profit from the futures market that they may not be making a net loss.

It is impossible to predict how long this trend will last as there is no basis for it. With the mainstay, stock moves are digested slowly. Our past experience has shown us that stocks that have skyrocketed in 2 months eventually come back at a similar rate.

We said that the CMB uses gross clearing to prevent this. So far, this measure has only been implemented in 2 banks. We have not seen such a measure at flagship banks.

We will probably never get a competent answer to our questions about why we didn’t see how this trend will end and the logic of this movement.

However, I have to say that the rumors are not pleasant at all…

All I can say is that you should never trade without making a stop.

*Financial market specialist

#Ive #market #years #Ive #move

No comments:

Post a Comment