Today I will tell you about the stock market. But the Turkish stock market is from Borsa Istanbul.

I have been trading Borsa Istanbul and futures markets for over 20 years. From time to time, in these markets, like everywhere else in the world, various shabes, scams and manipulation messages circulate.

However, at a time when the system was not yet automated and manual, there were so many scandals and bankrupt institutions that the market did not move a leaf on a customer basis for exactly 15 years. It was not possible to get over 1 million accounts. When I was an account manager, the clients I called said, “We can’t make money in the stock market, we’re just being scammed” and hung up.

Then a miracle happened, the stock market, which had collapsed in the first place with the pandemic that turned our lives upside down, began to recover and customers flocked to the stock market…

At the same time, the Twitter phenomenon began to gain market share, with some rumors that some were making marketing deals with the company boss and some were making deals with board manufacturers.

The system is very simple, the stock starts promoting when the catchers first say “the profit is worth the pocket”, they get off the train with a profit, those who hear the marketing later or those who believe in the motivations like “go on, watch out for the goods” are locked in the compartment when the train falls off the bridge. Those who boarded the train from the front began helping to market the phenomenon, and those unable to get off began begging for “help”.

During the same period, foreign investors quickly fled the market, while domestic investors began to feed their foreign sales with the unwise decisions of the economic administration due to record-breaking negative real interest rates. The foreign share has already reached 32.71%, with a record decline. In 2021-2022 alone, the outflow of foreign equity investors has reached $4.9 billion. With that exit, the day was born for local speculators. With the power of big capital, they began to move the boards easily, surpassing the small investor, even the professionals could not make money in the market. Pointless intraday moves and high volatility made short-term trading even riskier. With all of this, investors who added money in the 2021 rally gradually melted away their gains and became a loss in 2022.

Rumors and doubts continued to grow in the market.

We recently came across an interesting story;

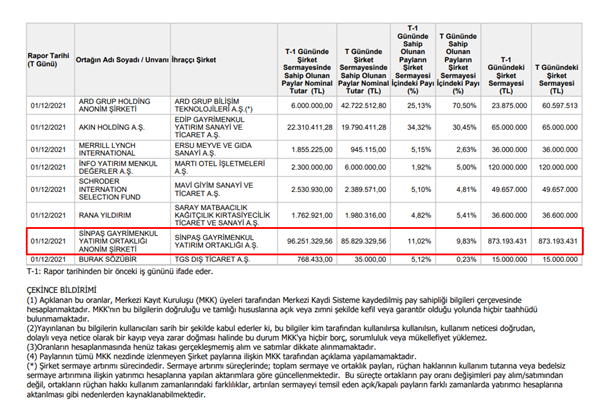

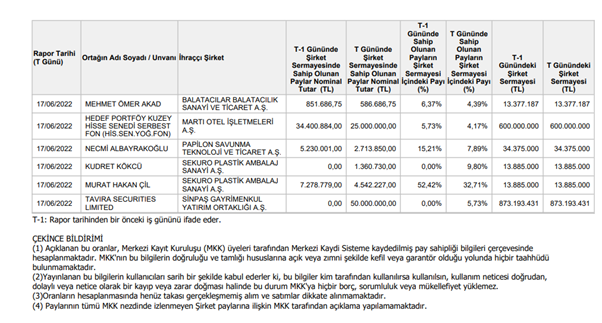

Sinpaş REIT, an established company founded by Avni Çelik in 1974, became a base with a sudden and large-scale sale on the stock exchange. The next day, again, and again today, the circuit breaker tripped and failed. Everyone was stunned when he ate sole for the first time. There was an ongoing project of the company in Marmaris Kızılbük, a report “EIA is not required” was issued for the project, then the city council filed a lawsuit for cancellation of this report in January 2022, after which the company made sales of 1 million TL im April and May, on June 28th We saw that the Chairman of the Board of Directors made a sale of 2.5 million TL in while on June 20th the news that Avni Çelik transferred a total of 50 million lots to the company named Tavira Securities Limited fell on the Public Disclosure Platform. Who was this Tavira Securities LTD.?

A company incorporated by Elliot Goodfellow on 3 June 2005 with registration number 5471230 providing financial services in the UK. It also has offices in Monaco and Dubai.

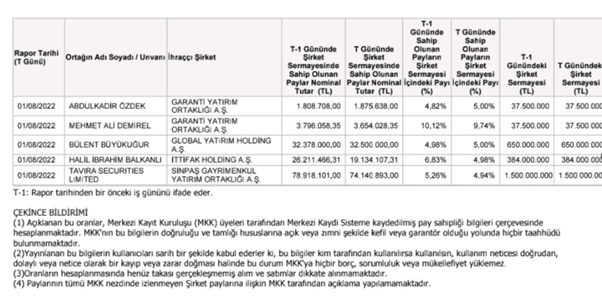

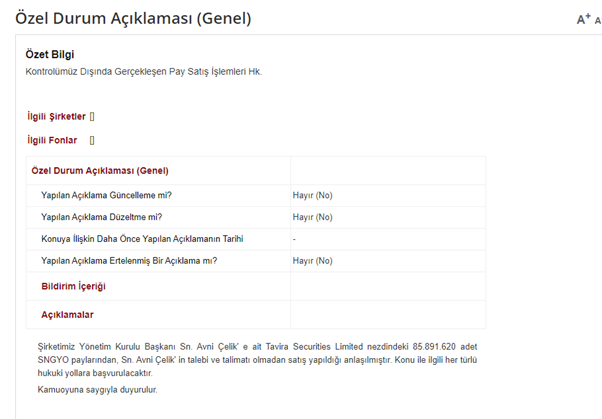

On August 2, it became known that Tavira Securities LTD was owned by Avni Çelik and that there were 85,891,620 lots of Sinpaş Gayrimenkul Yatırım Ortaklığı shares in the company’s account, and according to the article “part of it”, but according to the As of August reporting date, a total of 11.7 million tickets have been sold.

The container statement also stated that this sale was made without Avni Çelik’s knowledge. In other words, Avni Çelik’s company owned by Avni Çelik had sold 4.7 million lots by that time, not 3-5 lots without Avni Çelik knowing about the shares. As I mentioned earlier, SNGYO’s shares are down 25 percent since this sale. After this sale, the news of the cancellation of the report that there was no need for an EIA was coincidental.

In addition, small investors are hunted like sheep on the stock exchange, while the distribution of buyer-seller and intraday institutes can be seen in spot transactions, neither index nor buyer-seller can be seen in futures. Therefore, while the investor thinks that goods are sold or bought on the spot, the opposite can happen on the forward side, and the investor is, of course, wrong.

The main task of the Capital Markets Board CMB is to ensure the transparent and predictable functioning of the market and to protect retail investors.

Investors suffer from manipulation, insider trading and non-transparent indicators.

You cannot protect financial markets with financial centers and skyscrapers, and you cannot provide depth. Where there is no depth, low capital eats up big capital.

What did our ancestors say? This is the stock market…

Do not condemn the investor to this fate!

Resources:

CONTAINER

CRA

https://www.tavira-securities.com/about-us/

https://tavira.group/about-us/company-profile/

https://find-and-update.company-information.service.gov.uk/company/05471230

#Iris #Cibre #Stock #Exchange #Paraanalysis

No comments:

Post a Comment