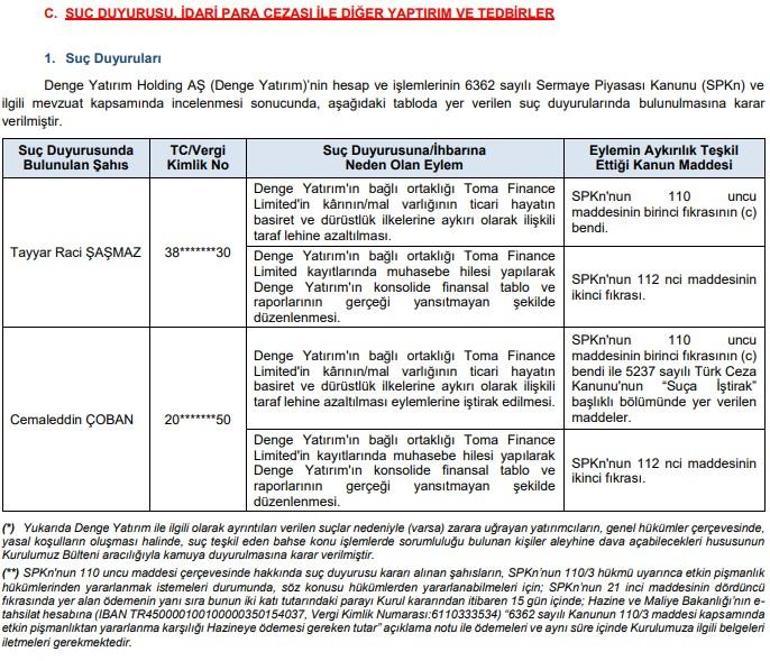

The Capital Markets Committee put Denge Yatırım Holding in the spotlight. As a result of the investigations conducted by the CMB, a criminal complaint was filed against Raci Şaşmaz and Cemalleddin Çoban, who were shareholders and CEOs of Denge Yatırım Holding before the sale.

The act that led to the criminal complaint against Raci Şaşmaz and Cemalleddin Çoban was reducing the profits/assets of Toma Finance Limited, a subsidiary of Denge Yatırım, in favor of the related party in violation of the principles of prudence and honesty of commercial life, Toma Finance Limited, a subsidiary of Denge Yatırım. It has been revealed that Denge Yatırım’s consolidated financial statements and reports were prepared in a way that was not truthful by using accounting fraud in its records.

THEY CAN BE PENALTY

As a result of the investigation, both names will be tried under the Turkish Penal Code. The irregularities are recorded in the Capital Markets Act.

class=”medianet-inline-adv”>

In Article 110(1) subparagraph C;

“Publicly traded partnerships and collective investment schemes, and their affiliates and subsidiaries, with any person or entity with which they have a direct or indirect managerial, auditing, or capital relationship, and differing rates, wages, and wages contrary to the principles of compliance with their peers, market practices, prudence and honesty of business, reducing their profits or assets or preventing an increase in their profits or assets through deals, prices, conditions or business practices or generation of transaction volume” and

in Article 112, paragraph 2, which is also included in the law;

“Intentionally;

a) who prepare the annual financial statements and reports in such a way that they do not correspond to the truth,

b) Those who open false accounts,

c) Those who commit all kinds of accounting fraud in the records,

ç) Those who prepare false or misleading independent audit and valuation reports and the responsible directors or responsible managers of the issuers who ensure that they are prepared shall be penalized in accordance with the relevant provisions of Law No. 5237. However, in order to impose a penalty for falsifying a private document, it is not necessary to use the falsified document. “A verdict will be made” will be prosecuted according to the regulations.

class=”medianet-inline-adv”>

DENGE INVESTMENT HOLDING INVESTORS ATTENTION

Investors who have suffered losses as a result of acts committed at Denge Yatırım Holding can file a lawsuit against Tayyar Raci Şaşmaz and Cemalleddin Çoban.

WHAT CAN BENEFITS FROM EFFECTIVE REGRET

If Tayyar Raci Şaşmaz and Cemalleddin Çoban want to benefit from the effective repentance provisions, they must deposit the money according to Article 21(4) of the Capital Market Law as well as double this amount to the account of the Ministry of Treasury and Finance within 15 days after the decision of the board.

Article 21 of the Capital Markets Act states:

class=”medianet-inline-adv”>

“In the event that the transfer of profits is determined by the board of directors, publicly held partnerships, collective investment schemes and their affiliated companies and subsidiaries shall apply, within the period to be determined by the board of directors, for the remitted amount to be remitted together with statutory interest to the partnership or collective Investment whose assets or profits have been reduced. The parties to whom proceeds are paid must reimburse the amount paid together with the statutory interest within a period to be determined by the Board of Directors. The legal, criminal and administrative sanctions provided for in the legislation on Articles 94 and 110 in relation to violating the ban on disguised profit transfer are reserved.

class=”medianet-inline-adv”>

HE HAS BEEN PUNISHED HIGHER BEFORE

Tayyar Raci Şaşmaz, who wanted to sell Denge Yatırım Holding shares in 2019, reached an agreement with Mustafa Uğur Bayraktar. However, the CMB discovered irregularities in the sale transaction and imposed one of the largest penalties of the period.

Regarding the transfer of shares of screenwriter and producer Tayyar Raci Şaşmaz from Denge Yatırım Holding to Mustafa Uğur Bayraktar, CMB fined Mustafa Uğur Bayraktar with a total fine of 6 million 153,000 232 lire for the irregularity in the takeover bid to be made afterwards . Mustafa Uğur Bayraktar was also the owner of Denge Investment Holding and Artı Investment Holding which traded on Borsa Istanbul in 2019. On the other hand, Artı Investment Holding was excluded from Borsa Istanbul on March 1, 2021 due to negative equity and the transaction regime was closed.

class=”medianet-inline-adv”>

WHAT IS THE SITUATION AT DENGE INVESTMENT HOLDING?

87.20 percent of Denge Yatırım Holding is open to the public. While the company has registered capital of 300 million liras, it has shareholders’ equity of 691,318,513 liras. The market value of the company is 528 million lira. Engineer Erdal Kılıç is the Chairman of the Board of the company, which has 6 subsidiaries and affiliated companies. On the last trading day, Denge Yatırım Holding traded at the level of 1.76 lira with a depreciation of 4.35 percent.

#Shock #Raci #Şaşmaz #CMB #filed #criminal #complaint #fined

No comments:

Post a Comment