Meriç Köyatası’s statement on his personal Youtube channel evaluated the situation of the markets.

The US Federal Reserve hiked interest rates by up to 50 basis points. However, the market glosses over this decision just because we bought it. The inflation figures were shocking. The TÜIK producer prices increased annually by 122 percent and the ENA group by 157 percent. The dollar is still hovering around 14.85. If we look at inflation in us and in the US, according to TUIK, the dollar should be around 18 lira and 10 cents, according to ENAG, it should be 19.53 cents.

Add to this the increase in borrowing costs in dollars due to the Fed’s interest rate hike and the foreign exchange demand that Turkey will need to cover its external debt and current account deficit.

The dollar is currently at 14.92 Turkish lira.

The main titles of economist Meriç Köyatası’s remarks on the markets are as follows:

WHAT’S HAPPENING TO THE DOLLAR IN THE MARKETS? WHY IS THE DOLLAR NOT MOVING AT THIS LEVEL OF INFLATION?

“The central bank sells through the back door all the time. But she has no gunpowder. Where will she find money? What will happen to the dollar in international markets, Turkey’s work is very difficult due to demand.

I calculated this chart by looking at the relationship between inflation and the exchange rate between the US and Turkey. Supply and demand for foreign exchange will also have different effects.

TURKSTAT said 7.25, that’s a miracle. How did TÜİK calculate such a number? I guess they don’t fit the spear in the sack anymore either. If you are interested in the manufacturer of TÜİK. We see beef consumer inflation going fast in 3.4 months.

ENAG is 56 percent and close to those numbers when I compiled them.

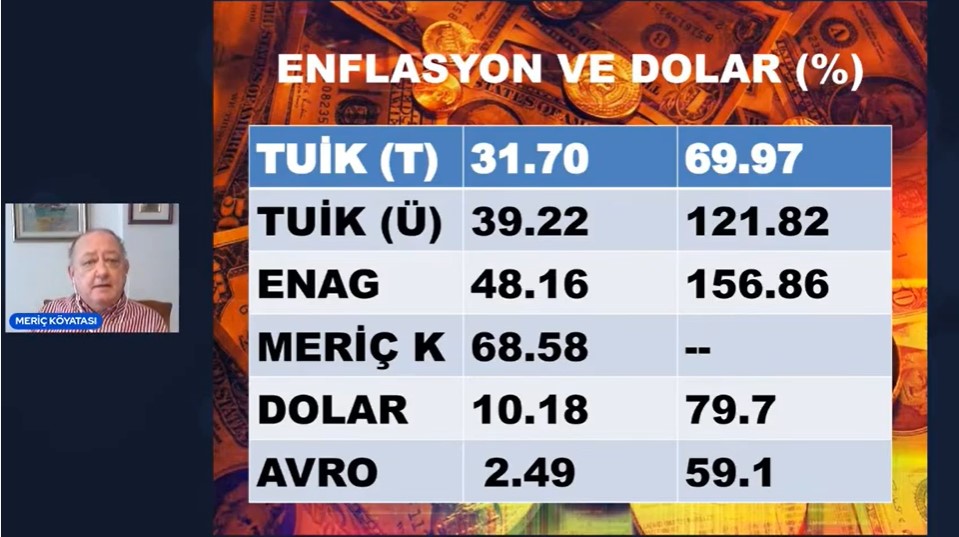

INFLATION AND THE DOLLAR

In this table we see what has happened since the beginning of the year, inflation – what has happened to the dollar – over the last 12 months.

In this table we see what has happened since the beginning of the year, inflation – what has happened to the dollar – over the last 12 months.

TURKSTAT’s 4-month inflation rate is way behind. In October, November and December the dollar recovered if we get this job from there. We can say that the dollar must fall, of course, if anyone believes that.

How many pounds should the dollar be? In this account there is no supply and no demand. In this chart we have taken into account inflation + consumer inflation in America.

The value the dollar should be at right now, some fellow market analysts say, if there are no abnormal backdoor sales, it will find 17 lire. I agree. This is a number based solely on inflation.

“Can’t the Central Bank count?” those who say. If the data is wrong, the calculation is wrong. So that the calculation is realistic

1- The starting point of the exchange rate is important (it would be wrong if we took it from December 18th) 2- Consistent measurement is required.

When all the laboratory conditions are right, when it’s balanced, when there isn’t much external debt, this should be the relationship between inflation and the exchange rate.

We need to match supply and demand. Apart from this offer, MB Back Sales MB own money?

Who stops the dollar, where?

I can’t find the answer to this question. I already predicted it would be $225 billion a year from now. By the end of the year I had predicted that the dollar would be 29.30 lire.

Business has gotten so out of hand and economic management errors have so multiplied that 11:30 p.m. is the most optimistic estimate. Much worse awaits us. However, don’t be surprised.

Creation of currency-hedged deposits

You know, there’s a currency-protected insole fabrication. The currency risk is $40 billion. Every 1 increase in the dollar is reflected here as a 40 unit increase. Every 1 lira increase in the dollar costs the budget 180 billion liras. This is wrong politics. You can multiply the pensioners’ salary by 2, you can give the EJT members their share. What else can be done? A real welfare state is emerging.

The budget deficit was estimated at $280 billion. The IMF spoke of 782 billion. Those are just numbers about us.

There is such a thing as a shakedown in the market

The US interest rate rose by 50 units. Don’t look at day traders. Look at the big picture, not the markets. 2,944 ten years. The number the FED will bring by the end of the year is 3! There is such a thing as a shaker on the market, be careful.

If it’s 3, you can think it’s going to earn 5 percent interest. They say, “We’re giving 4 percent interest now, we’re opening a home account2. nobody eats it You won’t eat either.

What percentage will you borrow?

interest in such a foreign market. While the dollar went to the US, while real interest rates in the world were so low, while money was plentiful in Turkey, it found foreign debt at 8.62. It gets even harder. Turkey’s domestic debt is $225 billion. This is a money to be found in 1 year. Where will he find this money? He will find it by spinning the debt. What percentage will you borrow?

How high will the dollar be at the end of the year?

The forecast that the dollar will reach 17.21 lire remains optimistic. At the end of the year, the 29, 30 remain optimistic. Make a note of it today, May 5th.

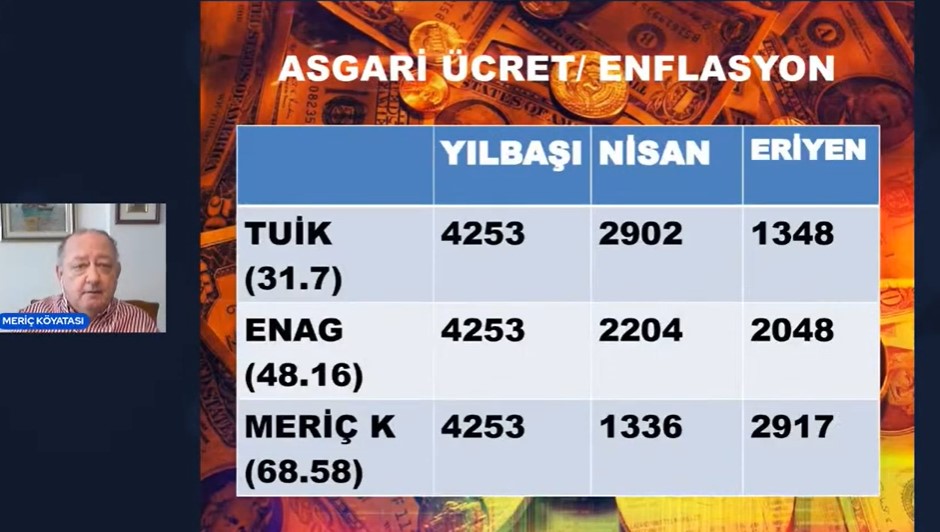

Inflation hurt those who couldn’t adapt. Erdogan said: “It hurt us a bit, what a lack of gratitude.” Now let’s look at those squeaks.

My share of food and heating is higher than others. By my estimate, the money the pensioner received melted by 68 percent in 4 months. So 2900 lire melted. I don’t understand what we call gratitude.

We are nearing the sad end of the country

Of my 3000 lira, 2700 lira flew. Democracy and peace cannot emerge from this picture. It turns out that the country’s sad end is near. There are many points in the country that cause unrest. There is religious politics, religious trafficking. On the one hand we have a refugee problem, the number of which has reached 10 million. There is hunger. There is the disappearance of the middle class.

We rank 149th in 180 countries for freedom of the press. Freedom of the press is essential for a country. It cannot be done by taking from the poor and protecting the rich.”

Similar news

#Economist #Meriç #Köyatası #explained #dollar #year

No comments:

Post a Comment